For membership sites that operate in Australia or cater to Australian members, understanding and implementing the Australian Goods and Services Tax (GST) is essential.

This guide explains how to apply the 10% GST rate to your membership site, ensuring business tax compliance and a seamless experience for your Australian members.

Understanding Australian GST

The Australian GST is a value-added tax of 10% levied on most goods, services, and other items sold or consumed in Australia.

For membership sites, you are required to add tax to membership fees if you are registered for GST. Businesses are required to register for GST if your sales into Australia exceed AUD$ 75,000 per annum.

The GST isn’t just a government requirement; it’s a crucial part of transparent pricing and maintaining trust with your members.

Determining if GST Applies to Your Membership Site

Not all businesses need to charge GST. If your organization meets these conditions, GST registration is required:

- Australian Businesses: Any organization registered for GST must apply the 10% GST rate to Australian residents’ membership fees.

- International Businesses: GST registration is only required if your Australian sales exceed AUD$75,000 per year. Without this threshold or GST registration, GST should not be added to fees for Australian residents.

About the Code Recipe

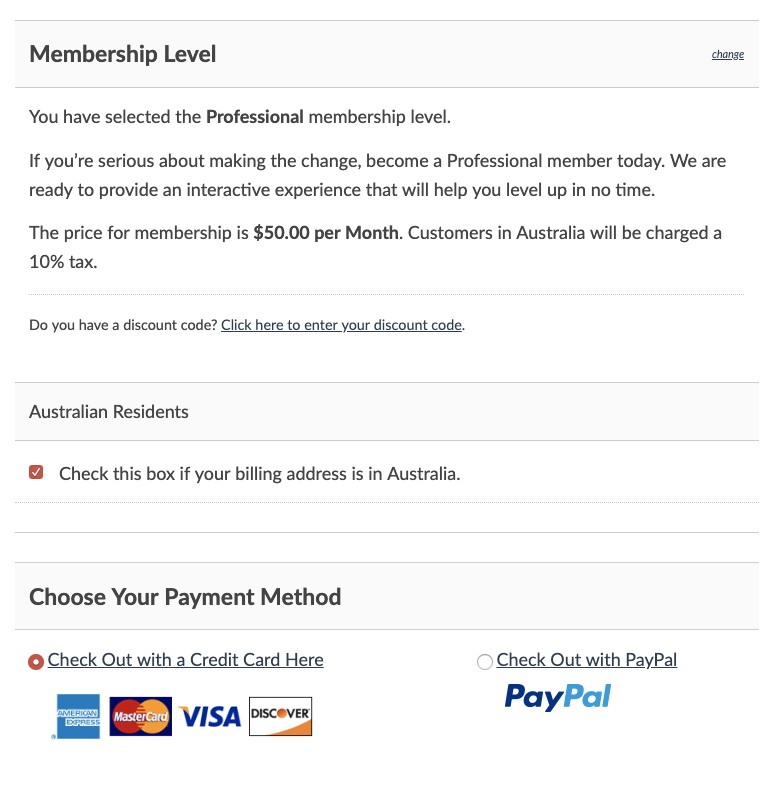

The code recipe below simplifies the process of adding GST to your membership site. The primary function of this recipe is to:

- Adjust the level cost text to inform Australian users about the additional 10% GST.

- Add a custom field on the membership checkout page, allowing Australian users to indicate their residency.

- Apply the 10% GST during checkout for users who confirm their Australian residency.

The Code Recipe

Adding the Recipe to Your Website

You can add this recipe to your site by creating a custom plugin or using the Code Snippets plugin available for free in the WordPress repository. Read this companion article for step-by-step directions on either method.

The code recipe will automatically add an option for users to check if they are Australian residents during checkout.

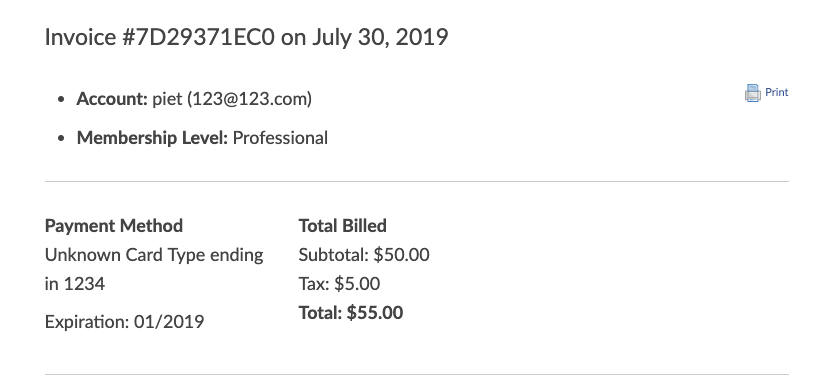

If members check this option, the system will automatically add a 10% GST to the total cost of their membership.

The updated cost, including the GST, will not be immediately visible to the user before finalizing their membership purchase. However, it will be included in the final price they pay for their membership.

FAQs: Australian GST and Membership Sites

Certain products or services may be exempt. It’s best to consult with a tax professional for specific cases.

Generally, GST on membership fees is not refundable. However, business members may claim credits for GST paid on their membership fees.

You should uniformly apply the standard 10% GST rate across all levels.

Only if the business meets the AUD$75,000 threshold for Australian sales and is registered for GST. International businesses that do not meet this threshold are not required to charge GST to Australian customers.

Australian GST: Final Thoughts

Implementing Australian GST correctly is crucial for membership sites with Australian users. It ensures compliance with local tax laws and maintains transparency with your members.

You can follow this guide to start accepting the 10% GST in your membership site, but please seek professional advice from local tax professionals to fully understand all the factors of GST, including your reporting responsibility.

You can also contact the Australian Taxation Office (ATO) GST for more information and help.