When establishing a membership site using Paid Memberships Pro, selecting the appropriate payment gateway is crucial. The right choice ensures smooth transactions and member subscriptions. Each website payment processor brings its own advantages and considerations.

The initial choice of your payment gateway can significantly influence long-term operations. Switching payment gateways is not an easy process and is not always possible. In this guide, we will walk you through payment gateway comparison so you can decide which payment processor would best suit your membership site.

Table of contents

Understand Your Audience and Geography

When comparing payment gateways and website payment processors, understanding your audience and their geographical location is important for several reasons:

- Accessibility and Reach: Some payment gateways are not available in all countries. For instance, PayPal operates in many countries globally, but it’s not available everywhere. On the other hand, regional gateways like Paystack are optimized for specific markets (like Africa in this case) and might provide better services or support in those areas.

- Customer Preference and Trust: Different regions often have preferred payment methods. For example, customers in Europe might prefer international payment methods like SEPA, while those in China might favor Alipay. Using familiar payment options can build trust and comfort with your audience.

- Regulatory Compliance: Payment gateways must adhere to the financial regulations of the countries they operate in. Certain regions have specific regulatory requirements (like PCI compliance in the USA, GDPR in Europe, and RBI regulations in India) that affect how transactions are processed and data is handled.

Analyze your business requirements, target audience, and their geographical location to ensure the gateway you choose is the right fit for both you and your customer.

Baseline Fees and Costs

Different gateways have varying fee structures. When choosing a website payment processor, it’s important to consider both transaction fees and monthly costs.

In addition, consider how the gateway accounts for currency exchanges and associated fees. Most payment gateways that integrate with Paid Memberships Pro handle currency conversions automatically for you—settling all your transactions in the default currency set in your account.

A gateway that offers competitive rates for the currencies most used by your audience can reduce costs for both you and your customers.

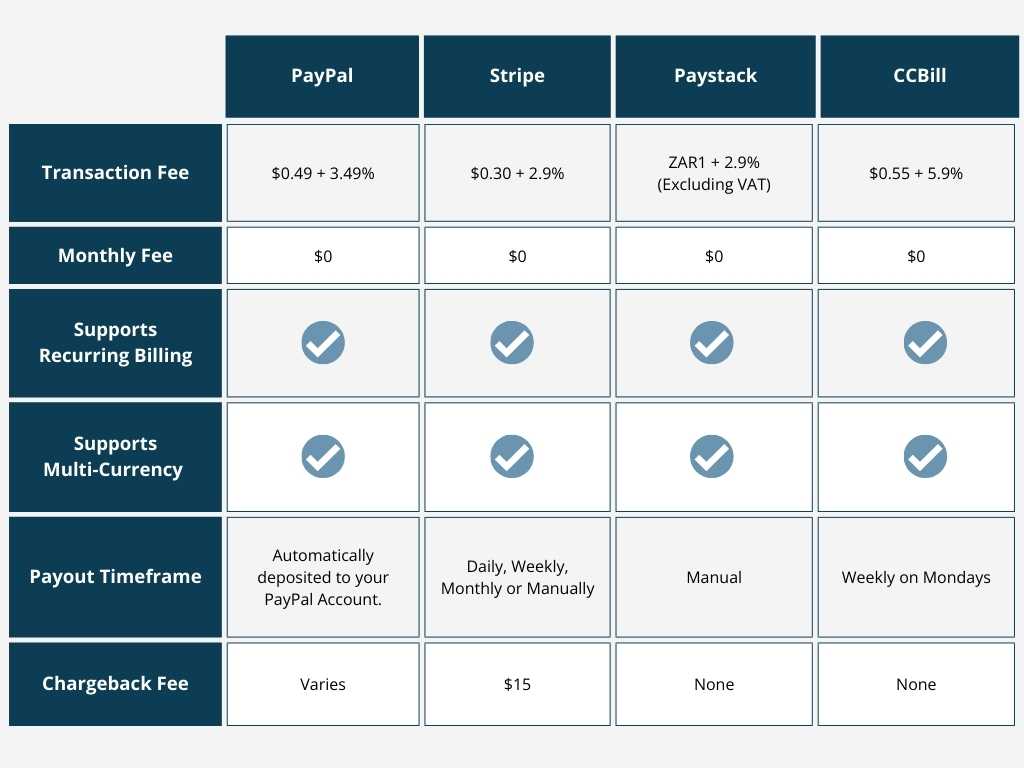

Comparison: Payment Gateway Fees and Costs

Below is a list of the published fees for US-based companies processing transactions over $3,000 USD per month. To see the gateway fees for your country, please check with the gateway directly.

| Gateway | Transaction Fee | Monthly Fee | Recurring Billing Fee |

| Stripe | $0.30 + 2.9% | $0 | $0 |

| PayPal Express | $0.49 + 3.49% | $0 | $0 |

| Paystack | ZAR1 + 2.9% (Excluding VAT) | $0 | $0 |

| CCBill | $0.55 + 5.9% | $0 | $0 |

This pricing was last updated on 2/26/2025. Current pricing may vary, so please check with each gateway directly to confirm current fees.

Estimating Your Payment Gateway Fees

Per-transaction and monthly fees aside, what would each gateway’s fees actually look like for your business?

Here’s a table showing the gateway fees for a membership site with monthly sales of $20,000 (1,000 units at $20/unit).

| Gateway | Sales | Fees | Revenue |

| PayPal Express | $20,000 | $1,188 | $18,812 |

| Stripe | $20,000 | $880 | $19,120 |

| Paystack | $20,000 | $634 | $19,366 |

| CCBill | $20,000 | $2,035 | $17,965 |

Getting Your Cash

Each website payment processor has their own payment transfer or settlement timeframe. This is the period of time between when the customer’s payment is accepted on your site and when the cash is deposited into your bank account.

For Stripe

The payout options vary a bit below, but in most cases funds are automatically deposited into your linked savings or checking account. Here’s a rough schedule of the payment transfer timeframe:

| Gateway | Timeframe |

| Stripe | Your transfer schedule can be configured within your account either daily, weekly, monthly or manually [more] |

Note that even though your gateway submits the transfer to your bank account, most banks only process the deposit on business days.

For PayPal Express

When using PayPal, the funds are automatically deposited to your “PayPal Account” when the payment is approved. Your PayPal account balance will continue to grow until you either initiate a withdrawal or configure automatic transfers.

For manual transfers, you must log in to your PayPal account to initiate a withdrawal to your linked bank account. This can be done via a few methods:

- Standard Transfer: Request a direct deposit to your checking account. Your request will be processed immediately, and your money will arrive in your linked bank account or eligible Visa or Mastercard debit or prepaid card in 3-4 business days.

- Instant Transfer: Request a transfer directly to your linked bank account or eligible Visa or Mastercard debit or prepaid card. The transfer is subject to a 1.75% fee and should arrive in minutes.

- Paper Check: Request a personal check from PayPal. This method is subject to a $1.50 fee. The check will arrive by U.S. Mail within 5 to 10 business days.

For automatic transfers, you can configure a minimum account balance and have any additional funds automatically transferred to your linked bank account. Navigate to Finance > Money in the PayPal dashboard to set up this feature.

For Paystack

You can manually start transfers from the Paystack dashboard. The transfer fees vary by country and sometimes by the amount you are trying to transfer.

For CCBill

CCBill sends payments weekly on Mondays. Payouts are determined by looking at the Billing Schedule and your Break Amount. The Break Amount can either be Time payouts or Money payouts. For more information, visit CCBill’s documentation on payouts.

Chargebacks, Disputes, Claims, and Inquiries

A chargeback or payment dispute is when a customer denies a payment you’ve received. Even if you offer a refund policy, there will be some number of customers that decide to simply call their bank and initiate a dispute.

Each gateway has a unique process for managing disputes. With PayPal, you can occasionally avoid the fee by simply issuing a refund, but if a full fraud claim was made, the fee is an unavoidable cost of doing business.

For the purposes of this post, the basic chargeback fees by payment gateway are compared below.

| Gateway | Chargeback Fee | Notes |

| Stripe | $15 | Stripe now charges an additional $15 fee when you counter a dispute, which will be returned if you win. Disputed charges are withheld from your next settlement [more] |

| PayPal | $0.30 | Disputed charges are immediately frozen in your PayPal balance; The fee for refunding a dispute/claim is the fixed fee portion of your transaction fee ($0.30); The fee for claims escalated to chargeback is $20 [more] |

| Paystack | None | Rather than charging per chargeback, Paystack calculates chargeback ratios [more] |

| CCBill | None | CCBill’s standard pricing includes chargeback fees (excluding EU Debit). [more] |

Integration and Development

Assess the ease of integration with your site. If you are using Paid Memberships Pro, all of our supported gateways can be configured with basic setting fields right in the WordPress admin.

If you aren’t using Paid Memberships Pro and have to code your own gateway integration, we have found that Stripe has the most developer-friendly APIs and deep documentation to support you.

One thing that makes gateway development easier is a developer or test account. Some gateways offer testing environments that exactly mirror their live API, while others don’t.

Security and Compliance

Security is paramount. Ensure the selected website payment processor complies with industry standards and offers robust security measures. When a customer signs up for your membership with Paid Memberships Pro, the recurring payment setup occurs at the payment gateway level, not within the membership plugin itself.

Most popular gateways, like Stripe, adhere to strict security protocols, providing peace of mind for both you and your members.

Another factor of security is how your payment gateway detects potentially fraudulent payments and blocks spam. Stripe offers a service called Radar which is designed to detect payments like this before they are authorized. You can adjust your Radar settings within your Stripe account.

Additional Features

Some gateways offer additional features beyond basic payment processing. For example, PayPal provides buyer protection, while Stripe Atlas assists in business incorporation.

Stripe also offers a built-in subscription tax system, so if you’re using Stripe Checkout with Paid Memberships Pro, you can be sure that appropriate tax is handled for you without any additional setup.

Increase Conversions With Multiple Gateway Options at Checkout

With Paid Memberships Pro, you can offer both an onsite or offsite credit card payment method, as well as other methods like PayPal, direct deposit, or check. If better checkout conversions sound good to you, read our full guide on offering multiple payment methods here.

Note For High Risk Content

Finally, consider whether the type of membership or subscription you are selling is “high-risk.” If your site offers adult content, focuses on online dating, or touches on anything related to a controlled substance, you may need additional verification and approval from the gateway. We’ve also seen gateways subject these sites to higher fees, longer settlement periods, and even proactive shut down by the payment gateway.

Consider these additional services and words of caution based on your site’s requirements.

Compare Payment Gateways

Time to Choose Your Gateway

In conclusion, the choice of a payment gateway for your membership site should align with your specific needs, budget, audience, and the overall objectives of your site.

Before you settle on a processor, take some time to compare payment gateways against the criteria in this post. Our goal is to help you make an informed decision, so that membership payments run smoothly and worry free. Here’s a recap of those criteria and our final recommendations:

- Fees and Costs: Gateways don’t vary too much here. Consider currency conversion rates if you expect significant international commerce.

- Getting Your Cash: Choose a gateway like Stripe that makes the settlement process simple and hands-off.

- Chargebacks and Disputes: PayPal is the most consumer and business-friendly option when it comes to chargebacks (giving you an option to refund before escalation).

- Security and Compliance: Every gateway that integrates with PMPro offers adequate security and compliance.

- Additional Features: Consider your business requirements and whether your membership falls in the “high-risk” domain.

Feel free to explore more content about each website payment processor offered with Paid Memberships Pro. Each gateway has a section with specific guidance on integrating and setting up payments in your membership site.

Remember, your choice today could significantly impact the user experience and success of your membership site in the future. Select wisely based on what best aligns with your site’s unique requirements.

Try Paid Memberships Pro: it’s easy to get started. Our most popular gateways are built-in or offered as a Free Add On. Every gateway supports recurring payments.

Get More Information, Setup Instructions, or Sign Up

- Stripe: [Gateway Info] [Sign Up]

- PayPal Express: [Gateway Info] [Sign Up]

- Paystack [Gateway Info] [Sign Up]

- CCBIll [Gateway Info] [Sign Up]